Editor’s choice

Northrop Grumman Adding Mobile Targets to B-2 Bomber Capabilities

The B-2 Spirit edges into a new era. Air Force engineers push the bomber toward…

Exclusive: Retired RAAF Fighter Jets Could Be Sent to Ukraine (excerpt)

Exclusive: Retired RAAF Fighter Jets Could Be Sent to Ukraine (excerpt) Published: / Updated: The…

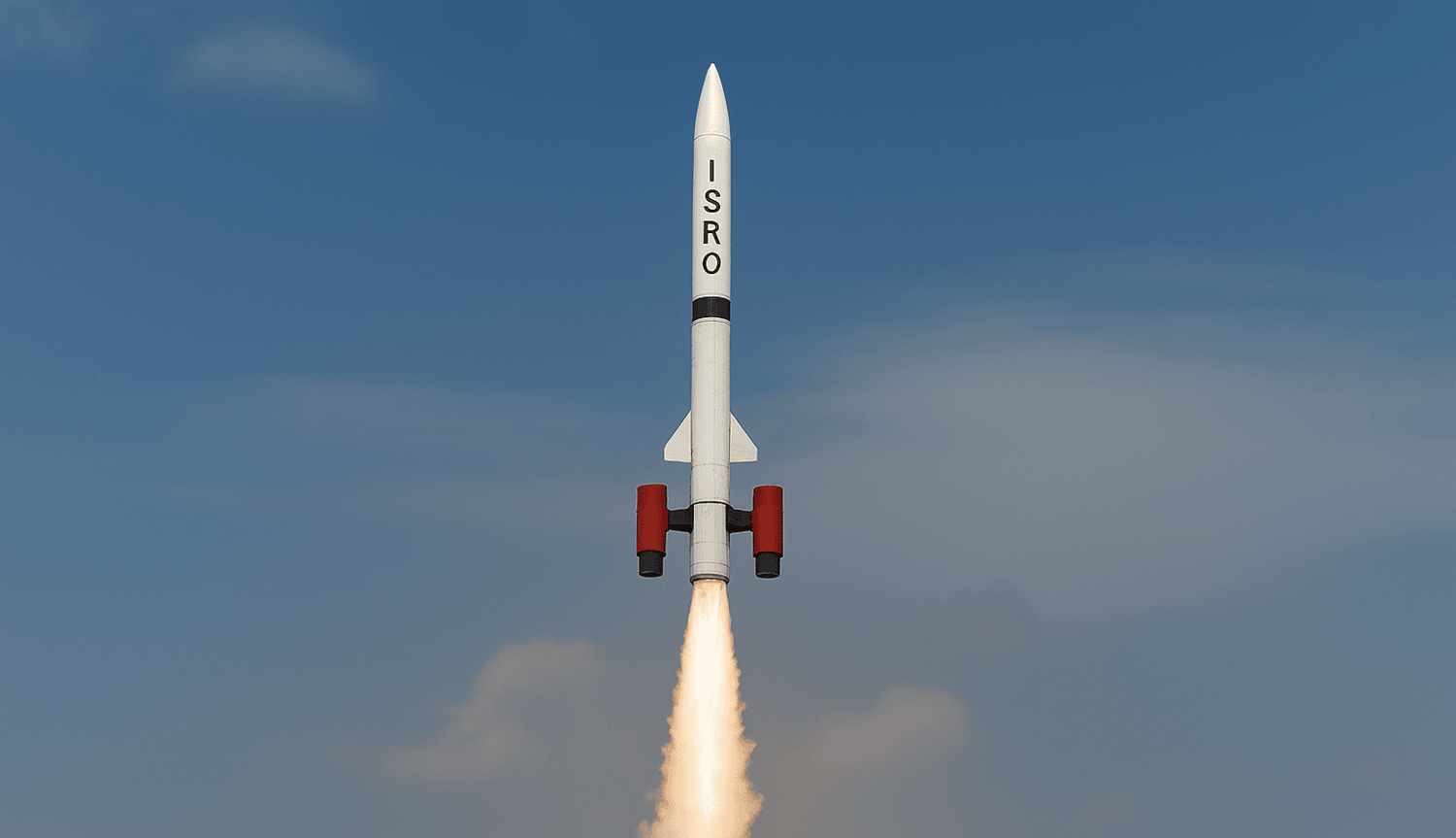

Successful Flight Testing of ISRO’s Scramjet Engine Technology Demonstrator

Successful Flight Testing of ISRO’s Scramjet Engine Technology Demonstrator Published: / Updated: The Indian Space…

Latest articles

The F-35: Even the Engine Is Compromised (excerpt)

The F-35: Even the Engine Is Compromised (excerpt) Published: / Updated: The F-35 promised reach…

Training for the Mission – Ukrainians Learn to Operate the Leopard 1 A5

Training for the Mission – Ukrainians Learn to Operate the Leopard 1 A5 Published: /…

Rafale in Combat: “War for Dummies”

Rafale in Combat: “War for Dummies” Published: / Updated: Pilots walk to their jets before…

Exclusive: Retired RAAF Fighter Jets Could Be Sent to Ukraine (excerpt)

Exclusive: Retired RAAF Fighter Jets Could Be Sent to Ukraine (excerpt) Published: / Updated: The…

Successful Flight Testing of ISRO’s Scramjet Engine Technology Demonstrator

Successful Flight Testing of ISRO’s Scramjet Engine Technology Demonstrator Published: / Updated: The Indian Space…

Eaton Wins Hydraulic System Contract For A380 – $200 Million Potential For U.S. Company

Eaton Wins Hydraulic System Contract For A380 – $200 Million Potential For U.S. Company Published:…

Romania Submits €10 Billion Military Upgrade Plan to Parliament

Romania Submits €10 Billion Military Upgrade Plan to Parliament Published: / Updated: Romania’s defense ministry…

The F-35 Fighter Jet, The World’s Costliest Weapons Program, Just Got More Expensive

The Pentagon just raised the F-35 bill again. Numbers inside its fresh acquisition report point…