Feature Stories

Singapore Wraps Up Island-Wide Air Defence Shield

Singapore Air Force chiefs say the Island Air Defence, or IAD, now works end-to-end over every shipping lane and flight path. Crews pushed…

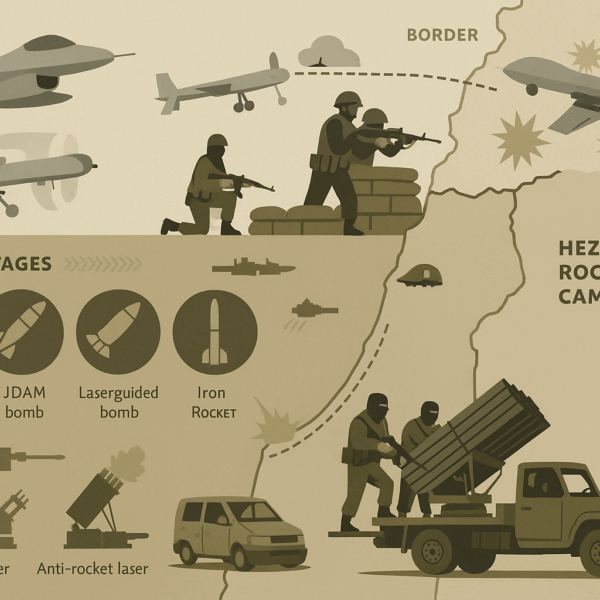

A Preliminary Military Assessment of the Lebanon Conflict

This article explains how the war was fought, looks at key military applications and technological successes and failures, examines the main battles and…

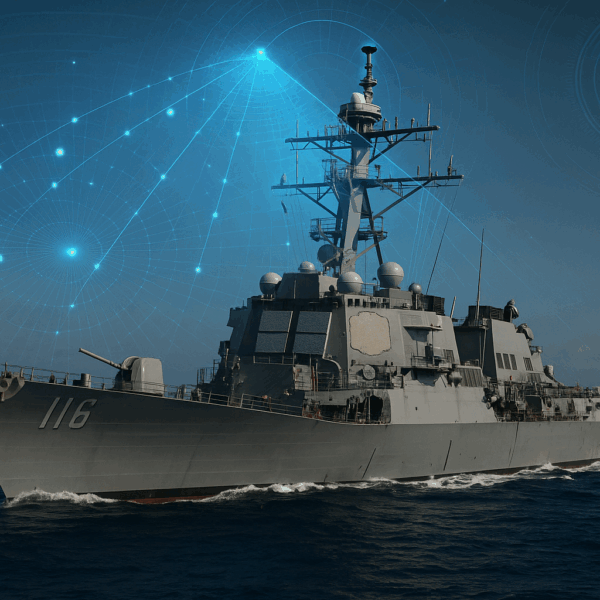

US Navy Awards $646M Raytheon Contract for SPY-6 Radar Expansion

The Navy has issued a $646 million contract option to Raytheon for four additional AN/SPY-6(V) radars. Defense officials confirm this is the fourth…

Russia’s Avangard Glide Weapon Reaches Mach 27, Kremlin Claims

Russia says its new Avangard hypersonic glide vehicle slices through air at Mach 27—about 33 000 km/h. Officers call it a “shift point”…

Press releases

Taranis UCAV Marks A Decade of Quiet Influence in British Air Power

The Taranis unmanned combat air vehicle once showed up in the corner of BAE Systems’ Warton site, almost out of sight. At first…

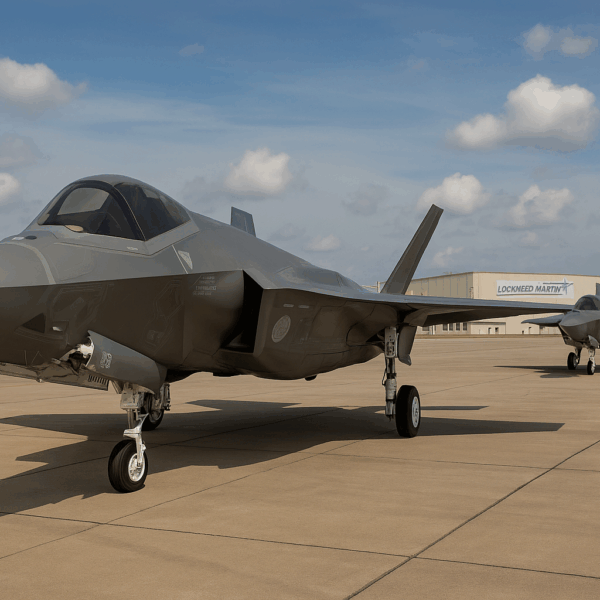

The Netherlands Buy Additional F-35 Fighter Aircraft

The Dutch government has ordered nine more Lockheed Martin F-35A Lightning II fighters, lifting the Royal Netherlands Air Force (RNLAF) plan from 37…

Weapons Tester Cites Further F-35 Challenges (excerpt)

The Pentagon’s Director of Operational Test and Evaluation has sent fresh shockwaves through the F-35 community. His memo to senior leaders says the…

Will the U.S. Retrofit Older F-35s to Fight or Buy New?

The Pentagon owns many early-lot F-35s that cannot meet full combat standards. Commanders now stand at a fork in the road: pour money…

Editor’s choice

Thales Signs £700 Million Watchkeeper Contract with MoD

The Ministry of Defence has signed a £700 million agreement with Thales UK to develop, manufacture, and support the Watchkeeper unmanned system. The single signature secures every major phase of work, from completing design through initial sustainment, under one integrated schedule.

China’s Expanding Drone Arsenal Reveals Strength of Civil-Military Integration

The first taxi runs of Jiutian’s SS-UAV “drone mothership” at a private airfield in Sichuan on 16 June reflect how far China’s unmanned programs have moved in a single decade. According to industry sources, technicians completed telemetry checks in less than six weeks, after the…

Poland Receives First AH-64D Apaches to Prepare for Guardian Fleet

Three AH-64D Apache attack helicopters landed this morning at the 56th Air Base in Latkowo, near Inowrocław. They taxied to the ramp in quick succession, rotors still spinning while ground crews signaled them into place. Defense officials confirm these aircraft now belong to the 1st…

Latest articles

Italian Air Force Orders 54 EJ200 Powerplants from EUROJET for Upcoming Eurofighter Batch

EUROJET Turbo GmbH has agreed to deliver up to fifty-four new EJ200 engines for the…

Why DARPA Cancelled Its DRACO Nuclear Thermal Propulsion Project

The Defense Advanced Research Projects Agency has closed the books on its Demonstration Rocket for…

Sierra Space Opens $45M Power Station Tech Center in Colorado to Scale Defense Solar Production

Sierra Space has placed its new “Power Station” technology center into full production. The site,…

FY 2026 Request: Space Force Seeks $277M for MILNET and Pauses Tranche 3 Transport Layer

The Space Force wants $277 million next year to launch the Military Internet (MILNET) constellation…

How the Air Force Is Using Sentinel Funds to Convert a Qatari 747-8 into Interim Air Force One

The Air Force just pulled part of its Sentinel missile budget and pointed it at…

Weapons Tester Cites Further F-35 Challenges (excerpt)

The Pentagon’s Director of Operational Test and Evaluation has sent fresh shockwaves through the F-35…

Aviation Week Reader Comments Above Story

Lockheed Martin’s F-35 program has drawn thousands of reader remarks on Aviation Week since the…

Milestone for AIR 5391

The Systems Division of Tenix Defence Systems today closed the Critical Design Review for the…