Sweden has taken its first big equipment step as a NATO ally. On 24 June 2025 the Swedish Defence Materiel Administration (FMV) confirmed a €830 million (≈ SEK 9 billion, $900 million) order for seven IRIS-T SLM fire units. Diehl Defence will produce the systems, but German procurement authorities signed on Stockholm’s behalf under the European Sky Shield Initiative (ESSI). Defense officials confirm that the contract will give Sweden a medium-range layer able to defend army brigades and the Gotland battlegroup against cruise missiles, helicopters, drones, and fixed-wing aircraft.

IRIS-T SLM Procurement via European Sky Shield Initiative

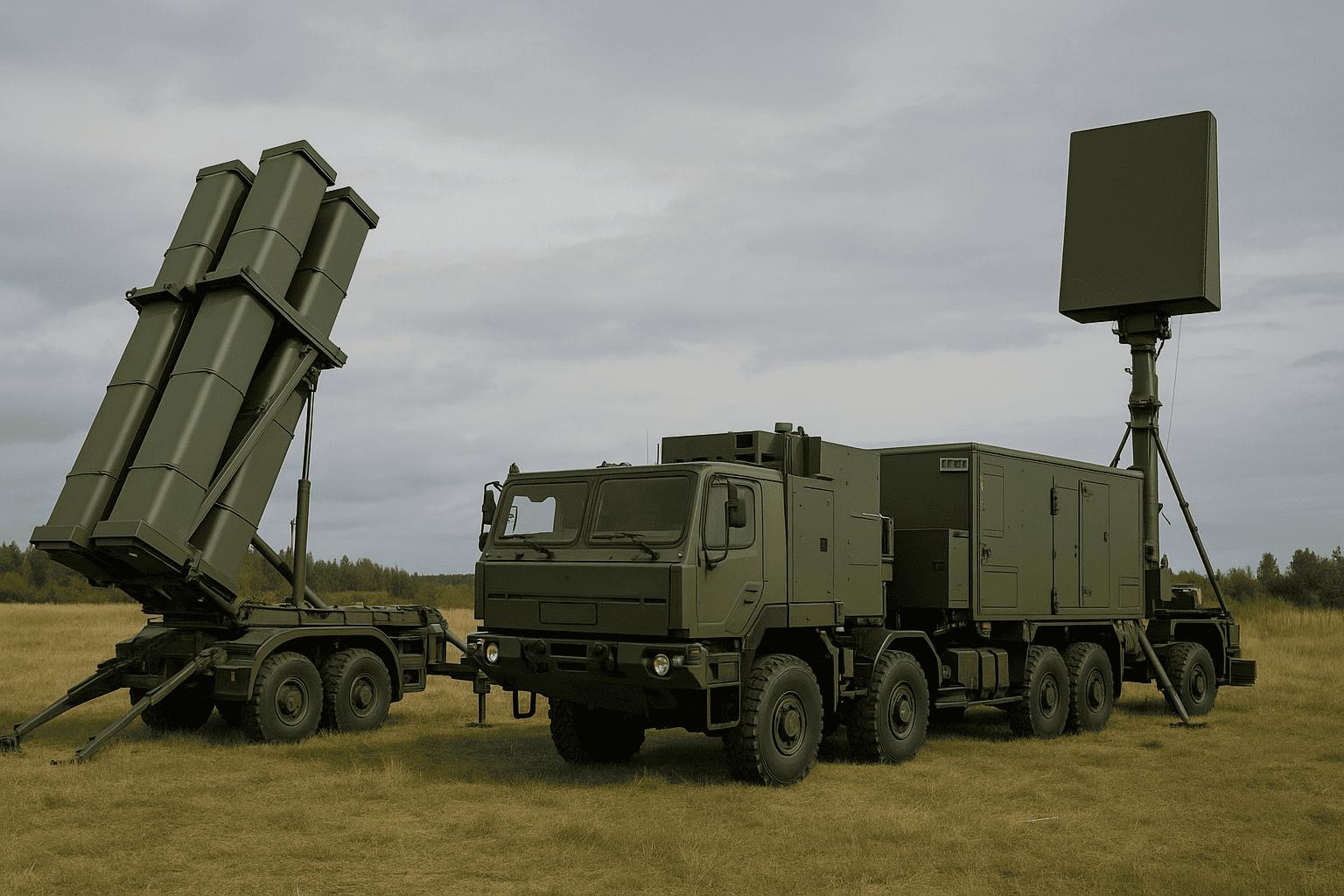

According to industry sources, the agreement covers every element needed for fielding complete batteries. The baseline package includes missiles, launchers, multirole radars, a battle-management system, reload vehicles, and spares. Production starts this fall at Diehl’s Überlingen plant. Final integration tests will run in Germany before each battery ships north. Sweden will own the hardware outright, but sustainment support remains a joint German-Swedish responsibility during the first decade of service.

Parliament approved funding through a supplemental defense bill adopted in April. The bill boosted 2025 spending to 2.2 percent of GDP – crossing NATO’s guideline three years ahead of the original plan. The IRIS-T purchase alone absorbs 11 percent of this year’s equipment budget, yet finance ministry data shows no schedule slippage for other headline programs such as the Luleå-class corvettes or the Archer Mk II artillery upgrade.

ESSI gives participating nations bulk-buy leverage on radar and missile components, plus standardized datalinks for cross-border engagement coordination. Our analysis shows that shared procurement shaved roughly 12 percent from Sweden’s expected unit price and removed the need to negotiate technology-release waivers, because Germany had already cleared export of the full software baseline.

Cost Savings and Interoperability Through ESSI Framework

The same policy shortcut accelerated Estonia’s order last year and is now being copied by Norway for its future point-defense requirement. Similar multinational procurement strategies are shaping Norway’s future air-defense plans.

The hardware mix looks like this:

- Missile: IRIS-T SLM with a stated intercept range of 40 km and ceiling above 20 km.

- Launcher: Eight-cell wheeled unit using Rheinmetall HX 8×8 chassis, reload in under ten minutes.

- Radar: Hensoldt TRML-4D active-array sensor, search volume 360° × 30°, track rate up to 1,500 targets.

- Command post: Diehl G-CA CE tactically hardened shelter with NATO Link 16, JREAP-C, and ESSI Tactical Data Link.

- Support vehicles: MAN HX-77 for reload, BAE Hägglunds BvS10 for Arctic spares delivery, Scania P-series workshops.

Diehl advertises a single-round kill probability above 90 percent against sub-sonic cruise missiles. Swedish testers at FMV’s Vidsel range will validate those numbers with live shots in early 2028. The seeker uses an improved IR sensor derived from the fighter-launched IRIS-T, but with a two-way datalink for midcourse updates. Unlike gripen-carried variants, the ground-launched missile ejects cold, then ignites a boost-sustain motor to minimize launcher signature. Defense officials confirm there is no plan to integrate an active radar seeker; Stockholm accepted the current design after classified threat-library reviews showed sufficient headroom against foreseeable decoys.

Interoperability drove the choice. Sweden already fields two Patriot PAC-3 batteries for high-altitude defense and RBS 70 NG teams for very-short-range cover. IRIS-T SLM sits squarely between those layers, filling a gap against targets flying below 10 km but outside RBS 70’s reach.

IRIS-T SLM as the Missing Middle Layer in Swedish Air Defense

ESSI’s open architecture allows the new batteries to plug directly into Sweden’s Luftförsvarsstridsledning C2 network without extra gateways.

The Artillery Regiment (A 9) will run operator courses at Boden starting spring 2027. An initial cadre of 80 soldiers travels to Diehl this November for factory acceptance training. The regiment will also receive containerized simulators to cut missile-expenditure costs during proficiency drills. All seven fire units must reach initial operational capability on home soil by December 2030, one year inside the Armed Forces’ long-term plan.

Logistics follows a balanced model. Diehl supplies missile canisters and critical spares for the first five years. Saab Dynamics manages domestic warehousing and repairs on sensors, launch electronics, and vehicle chassis. BAE Systems Hägglunds handles Arctic climate kits, reflecting its experience on CV90. According to industry sources, the sustainment package alone is worth about SEK 1.8 billion and keeps more than 250 Swedish technicians employed over the next decade.

The delivery timetable is fixed:

- Contract signature: 24 June 2025

- Critical design review: Q2 2026

- First battery roll-out: May 2028

- Swedish acceptance firing: September 2028

- Fifth battery hand-over: February 2029

- Final two batteries operational: September 2030

Gotland receives the first battery. The island sits barely 300 km from Russia’s Kaliningrad enclave and has limited natural cover, making air defense a top priority. The new system lets Sweden deny low-altitude corridors that current Patriot radars cannot prosecute at their maximum range, especially against sea-skimming cruise missiles launched from the Baltic Fleet.

Gotland Deployment Prioritizes Baltic Airspace Defense

IRIS-T batteries will frequently deploy during Aurora and Cold Response exercises, giving NATO operators a live testbed for cross-border missile engagement drills. Because ESSI users share a common planning environment, German, Latvian, and Swedish cells can trade tracks within milliseconds. The goal is to present a seamless missile wall from Norway’s coast to Lithuania’s eastern border.

Combat data from Ukraine shaped the Swedish requirement. Defense officials confirm that IRIS-T SLM batteries operating near Odessa since late 2023 have logged more than 250 intercepts on Kh-22 and Shahed platforms with no missile failures attributed to hardware. That record convinced Stockholm to adopt the system almost unchanged, avoiding a lengthy national customization phase that would delay deliveries past 2032.

The SEK 9 billion price breaks down as follows:

- 49 primary mission vehicles (41 %).

- 336 ready-round missiles plus reloads (27 %).

- Integration, C2, and software licenses (17 %).

- Training, simulators, and documentation (8 %).

- Ten-year spares and test equipment (7 %).

Gripen fighters will still carry the air-to-air IRIS-T in self-defense roles. The ground version cannot be fired from the aircraft, but shared seeker algorithms simplify supply chains and shorten update cycles for threat libraries. RBS 70 NG shooters will benefit indirectly as well. They gain early warning from TRML-4D feeds, allowing faster tripod setup and reducing risk of first-shot surprise from low-noise drones.

ESSI architects view Sweden’s order as proof that the framework speeds acquisition while respecting national sovereignty. Unlike past joint projects, each member can select the layer that matches its threat picture and budget. Germany coordinates provider contracts, but every country signs separate acquisition letters, letting parliaments maintain budget control. Such coordination aligns with an integrated EU-NATO investment approach promoted by several member states. According to industry sources, at least four more nations plan to join the next IRIS-T batch before year-end.

Rheinmetall CEO Armin Papperger predicts strong ripple effects for supply chains in Scandinavia. German truck chassis will ship to BAE Hägglunds in Örnsköldsvik for final outfitting, and Saab expects sensor harness work at its Gothenburg plant. Those workshares line up with Sweden’s new offset policy that ties major imports to domestic job creation rather than strict percentage rules.

Sweden accepted schedule risk tied to the tight production backlog. Diehl must balance Ukrainian replenishment, German Army modernization, and several export slots. The company set up a second final-assembly line in Röthenbach to handle growing output.

Production Challenges and Assembly Line Expansion in Germany

Even so, any new surge requirement – such as a sudden European demand spike – could push Swedish deliveries rightward. FMV inserted penalty clauses that trigger liquidated damages if the first battery slips beyond December 2028.

The agreement includes an option for the forthcoming IRIS-T SLX extended-range missile once development freezes in 2026. Stockholm will review that upgrade only after the SLM battery network reaches full operational capability. Defense officials confirm there is no current funding line for SLX, but the option keeps Sweden in the priority queue should the threat picture worsen.

Budget analysts see the IRIS-T buy as a bellwether for the next Swedish defense plan, due for parliamentary debate early 2026. It also reflects Sweden’s updated defense spending goals ahead of upcoming NATO milestones.

Future Swedish Air Defense Planning and Patriot Modernization

The Armed Forces already list additional medium-range batteries and a follow-on Patriot modernization in their wish list. Because ESSI can pool interceptors across borders, Stockholm may negotiate shared missile stockpiles with Finland and Norway to reduce lifecycle expense.

Industry reaction remained measured. Diehl shares closed up 3 percent after the announcement – about half the spike seen when Estonia signed last year – suggesting that investors had priced in the deal. Hensoldt stock rose 2 percent on the radar backlog boost. Swedish suppliers Saab and BAE Hägglunds traded flat, reflecting the long delivery horizon before revenue flows.

On the exercise front, Sweden, Germany, and Latvia will trial joint fire-control in Exercise Loyal Arrow 2026. The plan: connect IRIS-T SLM batteries over ESSI TDL and assign a single NATO Combined Air Operations Center to issue engagement orders.

Baltic IRIS-T Exercise Expands ESSI Tactical Integration

Successful execution will pave the way for a standing Baltic Air Defense Task Force under Allied Air Command.

The main challenge now is manpower. Sweden mothballed its last medium-range Hawk battery in 2000, leaving a skills gap that only recent Patriot courses have started to close. FMV aims to qualify 400 operators, maintainers, and planners before first fire-unit arrival. A mix of conscripts and reservists will fill crews, but the Armed Forces acknowledge that staff availability remains tight.

Looking ahead, planners anticipate limited life-extension for RBS 70. By 2032, IRIS-T may assume some short-range missions through a proposed SLS-Mod vehicle launcher, giving the Army a common missile family. That decision depends on cost-benefit studies yet to begin.

For now, the procurement delivers a timely capability boost and aligns Sweden with a multinational air-defense architecture built for distributed operations. It marks the first use of ESSI by a Nordic country and signals Stockholm’s intention to shoulder a larger share of regional security. Barring production shocks, the first IRIS-T battery will roll onto Gotland in three years, adding a new layer of protection for Swedish forces and, by extension, NATO’s northern flank.

REFERENCE SOURCES

- https://breakingdefense.com/2025/06/sweden-inks-900m-iris-t-air-defense-deal-through-european-sky-shield-initiative/

- https://www.government.se/press-releases/2025/06/sweden-purchases-new-air-defence-systems-for-the-army/

- https://militaeraktuell.at/en/sweden-procures-iris-t-slm-via-sky-shield-initiative/

- https://defence-industry.eu/sweden-acquires-iris-t-slm-air-defence-system-under-european-sky-shield-initiative/

- https://armyrecognition.com/news/army-news/2025/breaking-news-sweden-closes-air-defence-gaps-with-iris-t-slm-system-acquisition

- https://www.euractiv.com/section/defence/news/sweden-buys-german-air-defence-system-to-defend-gotland/

- https://thedefensepost.com/2025/06/24/sweden-german-air-defense-systems/