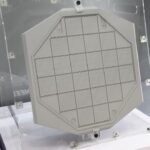

The first taxi runs of Jiutian’s SS-UAV “drone mothership” at a private airfield in Sichuan on 16 June reflect how far China’s unmanned programs have moved in a single decade. According to industry sources, technicians completed telemetry checks in less than six weeks, after the 15-ton airframe left the final assembly hangar in early May. The schedule holds for a maiden flight before month-end, an achievement that would give the People’s Liberation Army (PLA) its first airborne launch platform able to release more than 100 small strike drones on one sortie. The rapid pace recalls earlier rollouts such as the Z-20 helicopter, which similarly advanced PLA capabilities.

Defense officials confirm that the PLA Air Force and the Strategic Support Force share management responsibility for the SS-UAV project. The airframe uses a pair of commercial turbofans adapted for high-altitude cruise, flies almost 7 000 km without refuel, and carries a modular bay that swaps munitions, electronic-warfare pods, or cargo pallets in about two hours.

Drone Motherships and the Scale of Chinese Military Drone Deployment

Once tests validate flight-control software, planners intend to base the system on the mainland but patrol over the Philippine Sea and the Western Pacific, thus avoiding foreign basing negotiations. Flight tests in June 2025 are expected to confirm the swarm-launch capability of the platform.

Our analysis shows that the speed of this program rests on a national policy called military-civil fusion (MCF). The government gives tax breaks and export permits to private firms that align their research with PLA requirements. Commercial drone factories therefore run mixed lines: recreational quad-rotors by day, guidance kits for loitering munitions by night. The result is a production surge the United States and its allies still struggle to match.

Civilian-Military Integration Supercharges Drone Manufacturing

Three factors explain why output continues to climb:

- Strategic urgency – The Eastern and Southern Theater Commands list unmanned assets as the first tools for surveillance and strike options around Taiwan and the South China Sea.

- Industrial depth – China’s consumer-drone giants supply motors, optics, and flight stacks that fit military frames with little re-engineering.

- Policy integration – MCF regulations remove paperwork that once slowed military orders placed with private firms.

Since May, drones appeared in 31 of 38 PLA sorties that crossed Taiwan’s air-defense identification zone. Platforms ranged from cheap quad-rotors that film beach terrain to Wing Loong-10 jets that jam early-warning radars. Flight logs published by Taipei list loitering munitions on four occasions, the first public admission that expendable attack drones now operate inside Taiwanese airspace.

Tasks assigned to unmanned units already cover a broad spectrum:

- Intelligence, surveillance, reconnaissance

- Maritime patrol over choke points such as the Bashi Channel

- Precision strikes on ground and naval targets

- Suppression of enemy air defenses with small-drone salvos

- Electronic jamming of command nets

- Data relay for manned-unmanned teaming flights

- Offshore logistics drops to garrisons in the Paracels and Spratlys

Private Firms at the Core of Military-Civil Fusion Drone Supply

Operators now train for “one-to-many” control. Simulator syllabi limit crews to one pilot and one sensor operator for each flight element of up to eight drones. Ukraine combat-tested drone software is now influencing new control strategies adopted by regional partners. Photo evidence from an April drill shows a single console managing six quad-copters and two fixed-wing UAVs.

Production relies on three intertwined groups.

- State-owned enterprises – AVIC builds the Wing Loong family; CASC delivers Caihong designs; NORINCO handles VTOL and land-attack variants.

- Defense universities – Beihang, Northwestern Polytechnical, and Nanjing University of Aeronautics feed AI flight-control code and composite structures to industry partners.

- Private or mixed-ownership firms – Jiutian leads the SS-UAV line while Sichuan Tengden fields the TB-001 attack drone seen off Okinawa in April.

Dual-Use Supply Chains Feed the PLA Drone Arsenal

Assembly plants can switch civil lines to military work within 72 hours. Lithium-polymer battery makers in Shenzhen ship 50 000 drone packs each month. Camera modules intended for agricultural sprayers double as sensors in loitering munitions after technicians fit encrypted links. The speed of this switchover means that replacement drones could reach front-line units days after heavy losses, a lesson Beijing drew from attrition rates in the Russia-Ukraine war.

Output numbers underscore the point. Public tender data and satellite imagery of industrial zones suggest an annual ceiling near 20 000 military-grade drones across all classes. Roughly one third are cheap loitering munitions; the rest serve ISR and precision-strike roles. United States budget tables for 2024 list fewer than 5 000 comparable purchases, most in the micro-drone category.

Yet the system shows friction. Engineers still import certain heat-resistant alloys for high-altitude turbofans. Domestic chip foundries ship 16-nm nodes for AI inference, two generations behind leading Western fabs. Cyber audits in April flagged unpatched vulnerabilities in civilian ground-control software. The science-and-technology commission answered with subsidies and tax holidays aimed at firms that can close those gaps before 2028.

Chinese Military Drones Face Tech Bottlenecks but Outpace Rivals

Research now proceeds on two paths. First, manned-unmanned teaming pairs large drones with J-20 fighters for cooperative targeting. Second, CASIC trials sea-skimming UAVs that feed kill chains for anti-ship missiles. Neither reaches mass production yet, but test ranges in Hainan and Gansu ran live-fire events in May. Videos posted on local social media show target drones visibly maneuvering under autonomous guidance – footage quickly removed after upload. These efforts mirror other PLA advances in autonomous navigation, such as close GEO rendezvous for satellite refueling.

Defense observers note that PLA doctrine evolves with every lesson from Ukraine. After Russian quad-rotors lost GPS in jamming zones, Chinese manuals inserted optical-flow backup modes. Field units now carry spare inertial modules in kit bags. Engineers updated encryption standards to block takeover attempts similar to those used by Ukrainian electronic-warfare teams. Such rapid feedback loops mark a break from older, slower PLA procurement cycles.

Taiwan, meanwhile, seeks asymmetry. On 17 June, the National Chung-Shan Institute of Science and Technology signed a multi-year agreement with Auterion for swarm-control software tested over Kharkiv and Odessa. Defense officials confirm that firmware loads begin in July, covering thousands of locally built quad-rotors. The island aims to flood low altitudes with autonomous scouts that cue artillery and antiship missiles.

Drone Swarms and Asymmetric Deterrence in the Taiwan Strait

The imbalance remains stark. China can produce drones in volumes that no Western coalition yet matches. Unless rivals reorganize their civilian industries for military surge production, the PLA will preserve its numeric edge. The White House executive orders of 6 June attempt to stimulate U.S. output, but supply chains and regulatory frameworks still need time to react.

Analysts in the region therefore assess future conflicts through a new metric: replacement velocity. The side that swaps lost drones fastest can maintain sensor coverage, artillery cueing, and strike pressure. China’s MCF system currently delivers parts and airframes at unmatched speed. That advantage may narrow if allied economies adopt similar civilian-military integration, yet political reluctance and export-control regimes slow early efforts.

Military-Civil Fusion Gives China the Drone Attrition Advantage

Limitations still exist, and Chinese planners concede them in internal papers:

- Turbofan cores and ceramic matrix components rely on imported powders.

- Radiation-hardened chips lag behind U.S. equivalents.

- Secure satellite links depend on a constellation that reaches full capacity only in 2027.

- Cybersecurity audits uncovered back-doors in off-the-shelf flight stacks.

Each weakness drives new grants and joint-venture proposals, often pairing a university lab with a private firm that offers fresh venture capital. Government banks guarantee loans, reducing risk for investors. Outsiders voice concern that such directed finance compresses the innovation cycle far below market norms; Beijing officials reply that speed matters more than return on equity.

Experiments in automated manufacturing now move drone output toward “lights-out” factories. A plant outside Dongguan reported 22 million machine hours in the last fiscal year with labor present only for inspection shifts. Conveyor-mounted milling rigs machine composite spars for both delivery quad-rotors and reconnaissance airframes. The merged line keeps tooling flexible while preserving ISO quality audits demanded by export clients in the Middle East.

China’s focus on scale shapes operational concepts. A single SS-UAV orbiting east of Luzon could drop swarms that overload Aegis destroyer radar budgets. Smaller expendable drones launched from commercial trawlers might swamp visual channels and lure interceptor missiles away from manned aircraft. Doctrine now frames attrition as acceptable so long as production lines run. The concept mirrors Soviet Cold War missile math, but with cheaper airframes and AI targeting instead of steel rockets.

Taiwanese and Japanese planners counter with distributed early-warning nodes. Networked passive sensors will try to spot drone edges before clusters converge. U.S. Indo-Pacific Command tests in Guam added “leaky-bucket” kill chains, where cheap interceptors reduce saturation costs. Western developments like the Taranis stealth UCAV suggest similar attempts to shift doctrine toward autonomous and survivable platforms. Still, simulation runs at Stanford’s Gordian Knot war game in May predicted that a first wave of 5 000 super-cheap drones could exhaust inventory across two carrier strike groups within 48 hours unless reload ships arrive in theatre.

According to industry sources, Chinese suppliers now price micro-quad frames at under $400 for PLA bulk orders, a number that includes encrypted telemetry but excludes munitions. By comparison, Western inventory interceptors cost between $150 000 and $380 000 each. The economic gap forces defenders to invest in soft-kill and directed-energy solutions, technologies still maturing.

Defense-Aerospace editorial team judges that the next decisive factor will be software. Autonomy stacks that prioritize targets, allocate frequency bands, and coordinate return paths promise to cut operator load. China’s ability to harness talent from civilian AI hubs grants an edge. Western open-source communities push back, but export rules hamper code sharing with military customers, slowing adoption.

REFERENCE SOURCES

- https://aeronaut.media/news-en/uavs-drones-news-en/en-chinese-drone-mother-ship-jiutian-ss-uav/

- https://www.scmp.com/news/china/military/article/3310879/china-extend-combat-range-uavs-jiu-tian-drone-carrier-prepares-first-mission

- https://armyrecognition.com/news/aerospace-news/2025/alert-china-to-begin-flight-tests-in-june-2025-of-ss-uav-aerial-mothership-capable-of-launching-100-swarm-drones

- https://www.reuters.com/business/aerospace-defense/taiwan-seals-ukraine-combat-tested-drone-software-deal-help-deter-china-2025-06-17/

- https://auterion.com/auterion-and-taiwans-ncsist-announce-strategic-partnership-to-power-next-generation-defense-drones/

- https://breakingdefense.com/2025/06/auterion-signs-mou-with-taiwan-for-drone-swarming-software/

- https://www.scmp.com/news/china/military/article/3313893/why-red-tape-bigger-challenge-us-chinas-military-civilian-fusion-plan

- https://www.defenseone.com/ideas/2025/06/chinas-drone-arsenal-shows-power-civil-military-fusion/406118/